You’ve heard it a thousand times: “Buy real estate. They’re not making it anymore.” And it is good advice even if it’s as hackneyed as that other line you’re likely to hear in the same exchange: “Location, location, location!”

But what kind of real estate? The two broad classifications – commercial and residential – have a tendency to crowd each other out because there is only so much desirable space and so many builders. And commercial real estate has always had the edge because it by definition makes money. Investors love the monthly rents, whether they’re from office space, retail space, restaurants, hotels, self-storage, or multifamily apartment buildings.

Yes, apartment buildings are considered commercial. Residential real estate is mainly single-family homes with a smattering of duplexes, triplexes, quadplexes, and rowhomes. And, while it’s been a long time since housing prices have dipped, the value of your primary home is probably soaring now, even if the commercially oriented real estate investment trusts you hold in your investment portfolio are sagging.

Since the shutdown

According to the International Monetary Fund, U.S. commercial real estate prices have been losing steam since summer 2019, when rumors about a global pandemic were first murmured. Those prices had been increasing 11% annually but, a year later, they had dropped 3%. With fewer people going to the office anymore, fewer still going to the mall and virtually nobody going to resorts, demand was practically non-existent. Investors didn’t know how long the economy was going to be kept on hold, nor did they know what kind of “new normal” would emerge. It was clear, though, that people might not be going back to the office five days a week for some time – maybe ever. Further, people were getting accustomed to having their purchases delivered to their front doors, including full-course meals and even cocktails.

Meantime, with commercial real estate prices rising by double digits at the start of the pandemic, all the cranes in existence had been swinging across the world’s cities to build more towers. This boom would provide all that mixed-use space everyone was so convinced they needed. The result is today’s way-overbuilt environment.

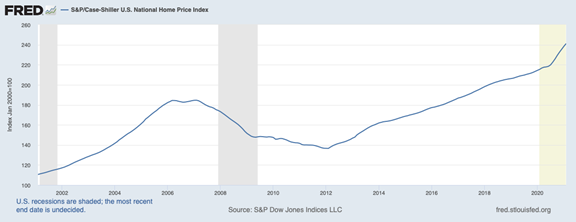

At the same time, people were getting accustomed to staying home. So accustomed they started getting sick of staring at the same four walls. We’ve had a “K-shaped” recovery – knowledge workers did just fine but the pandemic really set back people in other sectors – and those in the upper stroke of that “K” had the wherewithal to go hunting for four different walls. From March 2020 through February 2021, U.S. home prices skyrocketed. The S&P/Case-Shiller index – the most widely tracked benchmark for housing costs – rose almost 11%.

Already in play

While home prices hockey-sticked up over the past year, they had been tacking higher for years. The last time they dropped significantly was during the Great Recession, which had a lot to do with a housing bubble. It took four years to burn through the inventory, but then prices began an uninterrupted growth period.

That didn’t happen in a vacuum. The underreported fact is America was already facing a housing shortage long before the novel coronavirus moved in.

“To meet growing demand, America needs to build at least 4.6 million new apartment homes at all price points by 2030,” the National Apartment Association trade group pronounced in 2017. “In addition, as many as 11.7 million older existing apartments could need renovation during the same period.”

The study attributes this increased demand to many factors, with the primary one being the rate of household formation. Adults ages 18 to 34 are a large generational demographic group, and they have been delaying homeownership for years now.

Part of the reason for the delay was that there simply isn’t enough housing stock. For the past five decades, when demand had been this strong you could count on supply to catch up. Housing starts would peak between 2 and 2.5 million units per month seasonally adjusted – including both private homes and apartments. Immediately before the pandemic, it peaked at an anemic 1.6 million according to the Census Bureau.

What it means for you – and your kids

If you have children reaching the age when they’d like to move into their own places, the current real estate market’s message is actually dire.

It is an absolute seller’s market out there, and young adults might need extra help with that down payment and – let’s be real – those monthly mortgage payments. What tax-advantageous ways are there for you to help? Is this overheated moment the time to downsize your living space and free up cash for other purposes? Could the current trend be just a bubble that can be waited out with just a little patience? Nobody knows the future, but maybe it’s best to talk to somebody who knows the markets.